Beyond borders: what Pix Automático brings to the table for global merchants

With one-time authorization, subscription-based businesses reduce costs compared to credit cards, ensuring smooth cash flow and long-term customer retention.

Brazil has been at the forefront of payment innovation, with Pix revolutionizing real-time transactions since its launch. Now, Pix Automático is emerging as a game-changer, set to transform automated transactions in Brazil and redefine the future of payments, providing merchants with a seamless way to manage subscriptions.

But how does Pix Automático compare to similar innovations in other emerging markets? And what opportunities does it unlock for global companies? In this post, we explore the evolution of automated payments worldwide and how Pix Automático is poised to reshape recurring transactions for international businesses.

The power of one-time authorization: Pix Automático's breakthrough recurring payments

What makes Pix Automático unique is its frictionless payment process that allows Brazilian merchants to set up recurring payments with just a one-time authorization. This simplified process enhances the customer experience by reducing friction in the payment flow, resulting in fewer failed payments and improved subscription management.

Key benefits:

- Direct settlement rail – fewer intermediaries: Unlike card payments, which involve issuers, acquirers, card schemes, gateways, fraud solutions, and tokenization providers, Pix Automático runs on the direct bank-to-bank infrastructure of the Central Bank of Brazil (BCB). Fewer players means fewer points of failure—and lower costs.

- Real-time settlement: While traditional credit and debit card payments settle on delayed cycles (e.g., T+30 for credit, T+2 for debit), Pix Automático leverages the instant settlement of Pix rails. That means no advance payments or hidden financing costs—just money flowing in real time.

- One-time authorization, seamless automation: Customers approve the recurring transaction once through their banking app, and future payments are processed automatically—removing friction and manual steps from the payment journey.

- Cost efficiency: With no card schemes or intermediaries involved, transaction fees are significantly lower than traditional credit card payments, making Pix Automático a more sustainable option for recurring revenue models.

- Inclusive and accessible: By eliminating the dependency on credit cards, Pix Automático extends reach to millions of underbanked users in Brazil who rely on their bank accounts but may not have access to card networks.

- Flexible payment journeys: The BCB has defined four possible flows for Pix Automático, offering flexibility to tailor experiences to different business models—whether you need push or pull logic, fixed amounts or variable pricing.

Pix Automático doesn’t just replicate the card experience—it redefines how recurring payments should work in emerging markets. It’s fast, direct, and built for the future of digital commerce.

Cutting costs with Pix Automático

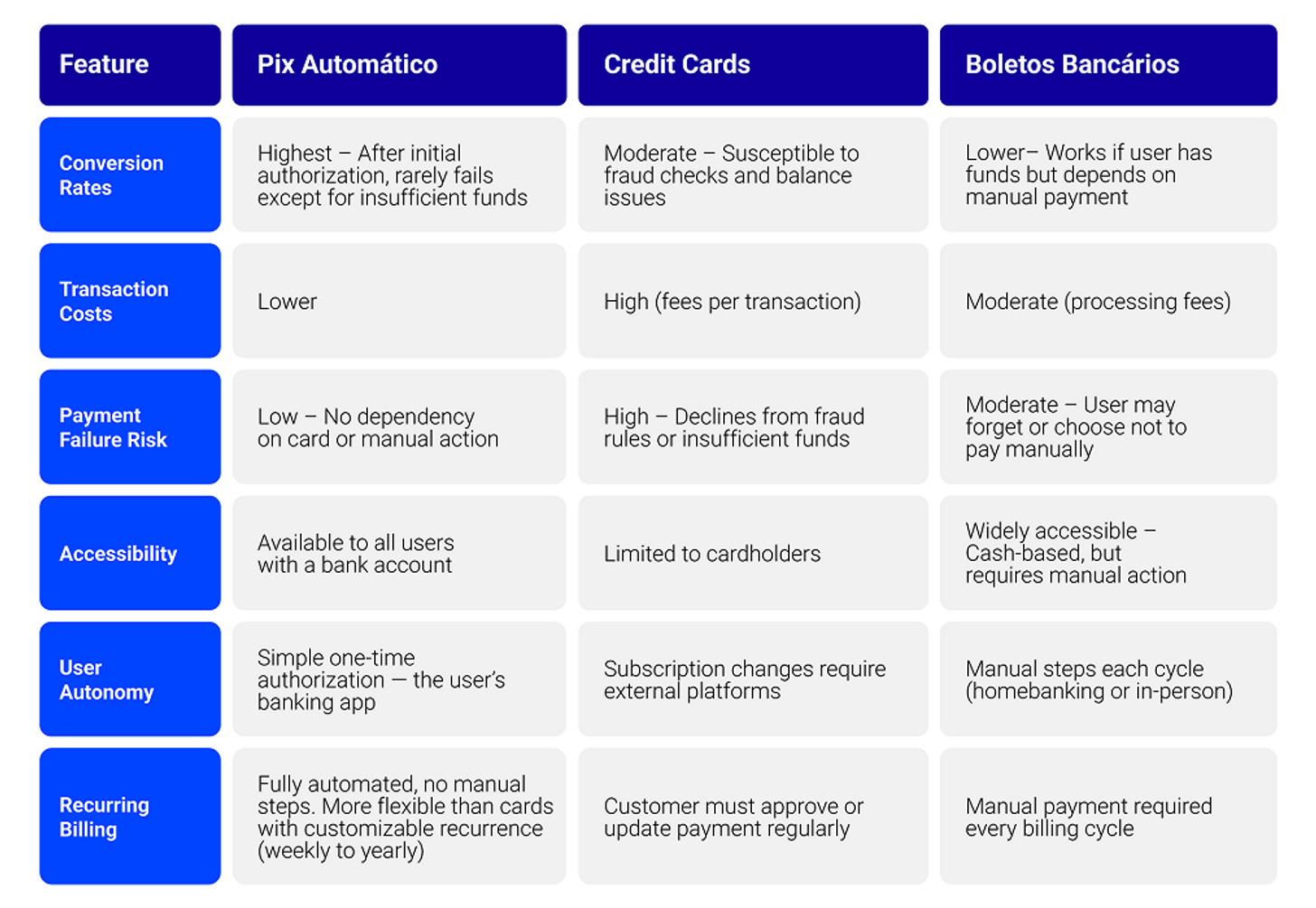

To understand the significance of Pix Automático, it's important to highlight its economic benefits for merchants, especially in comparison to traditional credit card payments.

Pix Automático offers a cost-effective alternative to credit card payments by significantly reducing transaction fees. Traditional credit card payments often involve high processing fees, particularly for international transactions, which can erode margins for merchants. In contrast, Pix Automático benefits from lower transaction costs by utilizing Brazil's real-time payment infrastructure, avoiding the fees typically associated with credit card networks.

Economic advantage for merchants

By eliminating the need for intermediaries, Pix Automático provides merchants with a more affordable, streamlined solution for recurring payments. This is particularly beneficial for businesses managing subscription models, where recurring transactions are common.

Look out – tailored benefits for your business model

Digital subscriptions

Pix Automático is ideal for subscription-based services such as streaming, SaaS platforms, and e-Learning. By automating recurring payments, it reduces churn and ensures customers can easily continue their subscriptions without worrying about payment failures. Whether on a monthly or annual billing cycle, it provides a frictionless experience with minimal manual intervention.

Seamless Plan Upgrades: Customers can move between different subscription tiers (e.g., individual to family plans) without requiring new payment authorizations, ensuring an uninterrupted experience.

E-commerce & marketplaces

For e-commerce businesses and marketplaces, Pix Automático enables product subscription models. Customers can sign up for "subscribe and save" offers with automated recurring payments, ensuring seamless and consistent transactions. This results in a smoother checkout process, enhancing customer loyalty and improving conversion rates.

Flexible Payments: Businesses can accommodate changing customer needs, such as adjusting plans or upgrading product subscriptions, without additional friction.

Utility services

For utility services like electricity, water, and internet, Pix Automático enables customers to automate their bill payments. This guarantees that customers never miss a payment, reducing late fees and service interruptions. Automated billing also allows utility companies to reduce administrative costs while improving customer satisfaction.

Scalable billing adjustments: Enables service providers to adjust pricing dynamically (e.g., seasonal utility price changes) while maintaining seamless recurring payments.

The next big shift in digital payments

As recurring payments gain traction globally, solutions like Pix Automático are setting new standards for seamless, localized, and efficient payment systems. By embracing these innovations, global merchants can not only enhance customer retention but also unlock new opportunities in key emerging markets.

With dLocal, businesses gain access to the tools and expertise needed to navigate the complexities of international payments—scaling smarter and faster while ensuring frictionless transactions.

Stay ahead of the curve. Explore our API’s documentation to understand how to integrate Pix Automático into your business model and start testing now.

Get in touch with our payment experts

We help global companies such as Amazon, Spotify, and Microsoft find new opportunities in high-growth markets. Let's think outside the box for tailor-made payment solutions for your business. Fill out this form, and we'll get back to you as soon as possible.

Contact us