Cash: The resilient bridge to the digital economy in emerging markets

Discover why cash remains critical for eCommerce in emerging markets. Learn strategies for effective cash management to unlock growth in LATAM, Africa, and beyond.

Global merchants expanding into emerging markets often operate under the assumption that "digital-first" means "digital-only." However, in many high-growth regions, cash remains a currency of trust, habit, and necessity. It is a vital bridge connecting millions of unbanked and underbanked consumers to the global digital economy.

From Mexico to parts of Africa, cash allows users to initiate transactions online and finalize them in person using physical currency. This unique hybrid model makes eCommerce and digital services accessible to those without cards, bank accounts, or eWallets. For businesses, ignoring cash means ignoring a massive segment of the total addressable market.

Why is cash still relevant in a digital-first world?

In advanced economies, cash usage is declining drastically. But in emerging markets, the story is different. Cash fills critical gaps that digital methods cannot yet address.

Cash persists because:

- Trust and habit: In many regions, physical currency is the only trusted medium of exchange.

- Accessibility: It allows for participation in the digital economy without requiring a bank account or credit card.

- Necessity: It serves populations where digital infrastructure may still be developing or unreliable.

By allowing users to shop online and pay offline, cash acts as an inclusive tool, ensuring that the digital revolution doesn't leave behind those who rely on physical currency for their daily lives.

How can businesses effectively integrate cash into their strategy?

The most successful online global businesses understand that fighting cash is a losing battle. Instead, the winning strategy is to work with cash.

To build trust and loyalty, businesses must embed local cash options into their payment flows from the start, which involves:

- Becoming part of daily life: Offering payment methods that fit into a customer's existing routine builds immediate trust.

- Investing early: Companies that offer familiar payment methods early on consistently outperform slower entrants who wait for the market to "digitize" completely.

- Adapting customer experiences: The checkout flow must clearly guide the user from an online order to an offline cash payment point.

What technologies are bridging the gap between cash and digital?

Far from being low-tech, modern cash management relies on sophisticated infrastructure to link offline shoppers with online merchants.

Key examples of this technological bridge include:

- Voucher-based systems: Solutions like OXXO in Mexico, Fawry in Egypt, or Boleto Bancário in Brazil allow customers to generate a payment reference online and complete the transaction with cash through trusted local networks.

- Mobile money integration: In many African markets, mobile money acts as a digital interface for cash. Users deposit and withdraw physical currency through agent networks and pay digitally via services like M‑Pesa.

- Payment hubs: Neighborhood stores and kiosks act as familiar places where customers complete online purchases by paying in cash.

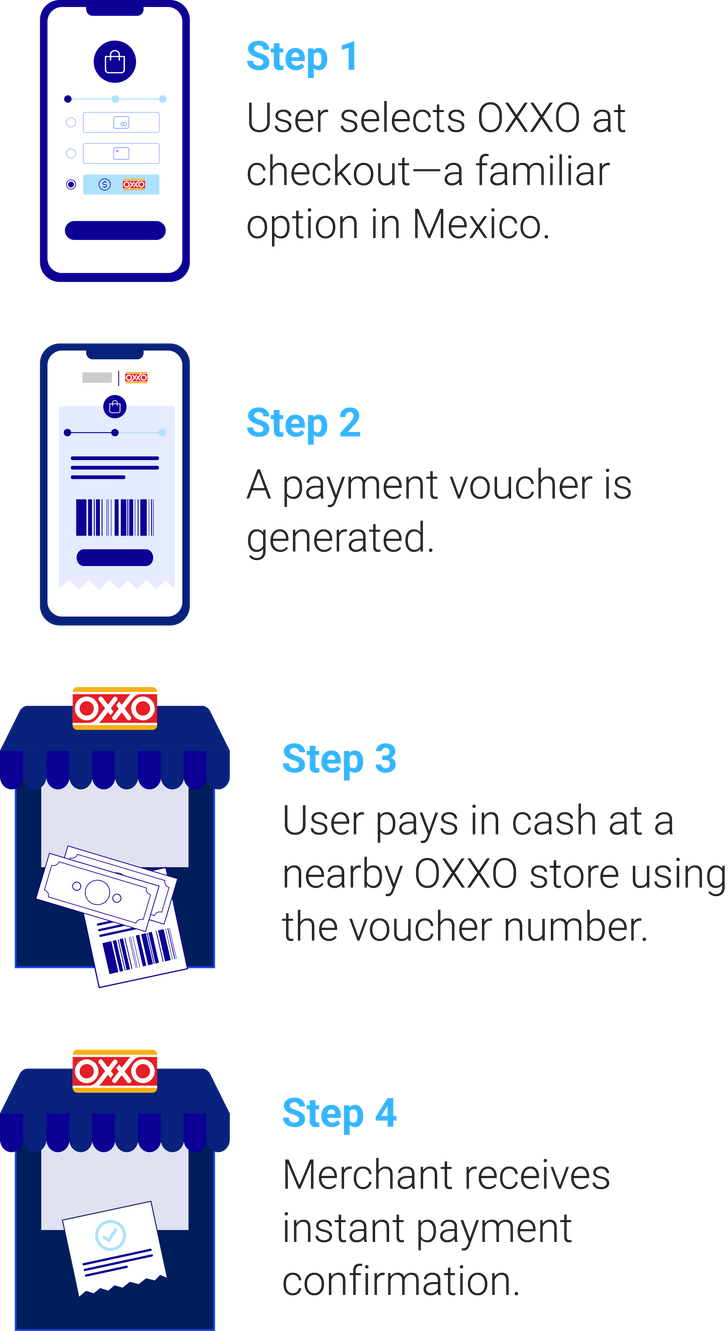

How cash vouchers connect offline shoppers to online commerce

What challenges do businesses face in cash management?

While the opportunity is vast, the operational reality of cash management is complex. Merchants face a landscape defined by fragmented payment systems, shifting regulations, and macroeconomic risks.

To succeed, they must prioritize:

- Compliance: Meeting local regulatory requirements is non-negotiable for long-term operation.

- Standardization: Aligning complex processes like dispute management and recurring payments with global standards helps speed up operations.

- Security: As with digital methods, ensuring the security of the transaction from the online order to the physical payment is paramount.

Which industries rely on cash-inclusive strategies?

The role of cash in emerging markets is not uniform. Industries like retail, food delivery, and utilities rely heavily on cash-inclusive approaches to ensure broad access and customer satisfaction.

- Retail: Online stores can reach more customers by offering cash payments at physical locations, ideal for those without cards or bank accounts.

- Food delivery: Adding cash and local payment options helps food delivery platforms attract new users and bring back dormant ones with familiar payment methods.

- Utilities: Essential service providers like electricity or telecom can support unbanked households by enabling cash bill payments at convenient local spots.

These industries demonstrate how adapting to local payment preferences---especially cash---creates opportunities for growth, customer loyalty, and widespread adoption of digital services.

Future trends: The convergence of cash and digital rails

While digital payments are outpacing cash in growth, the two systems are becoming increasingly interconnected rather than mutually exclusive.

We are moving toward a future defined by:

- Invisible payments and smarter infrastructure: Technology is making the handover between cash and digital rails more seamless.

- Real-time connectivity: Instant transfers, tokenization, and recurring payments are becoming baseline expectations, even in markets traditionally dominated by cash.

- Borderless commerce: As infrastructure improves, the barriers between local cash economies and global merchants continue to fall.

Conclusion: Meeting customers where they are

For global merchants, supporting cash-inclusive flows is a core requirement for offering relevant online payment services in emerging markets.

Companies that invest in these hybrid flows---offering familiar payment methods while meeting compliance needs---will secure loyalty before their competition does. In the race for global growth, the ability to accept a cash payment for a digital good is often the difference between a cart abandoned and a customer gained.

Frequently Asked Questions

What is a voucher system in payments?

A voucher system allows customers to initiate a purchase online, receive a one-time payment reference or voucher, and complete the transaction in cash at a physical location such as a convenience store or payment agent.

How do cash vouchers work for online purchases?

Cash vouchers let customers shop online first and then pay the exact amount in cash offline. Once the voucher is paid, the merchant receives confirmation and can fulfill the order.

Are cash vouchers considered online payment methods?

Yes. Even though the payment is completed with cash, cash vouchers are considered online payment methods because the transaction starts digitally and is reconciled online.

What are the most common cash payment methods in emerging markets?

Common cash payment methods include voucher-based systems, bill-pay networks, retail payment hubs, and agent-based models where customers pay cash for online or digital services.

How do cash payment methods support eCommerce growth?

Cash payment methods allow unbanked and underbanked consumers to access eCommerce by separating the digital checkout from the physical payment, expanding reach and improving conversion rates.

Are prepaid cards the same as cash vouchers?

No. Some prepaid cards can be funded with cash, but they require users to load value in advance and manage a balance. Cash vouchers are tied to a specific purchase and are paid after checkout.

Do cash-based online payment methods work with mobile money?

Yes. In many regions, cash-based flows coexist with mobile money, where users deposit or withdraw cash through agents while completing digital transactions online.

Will cash payment methods disappear as digital payments grow?

Unlikely in the near term. While digital payments are growing quickly, cash payment methods remain critical in many emerging markets because they fill trust, access, and infrastructure gaps that digital-only methods cannot.

Get in touch with our payment experts

We help global companies such as Amazon, Spotify, and Microsoft find new opportunities in high-growth markets. Let's think outside the box for tailor-made payment solutions for your business. Fill out this form, and we'll get back to you as soon as possible.

Contact us