Stablecoins: a bridge for global businesses operating in emerging markets

Stablecoins are transforming how global companies operate in emerging markets, offering stability, instant cross-border transfers, and a practical workaround to FX and banking limits.

What you need to know

- Stablecoins are becoming an essential tool for cross-border payments in emerging markets.

- They offer faster settlement, lower operational costs, and protection against local currency volatility.

- Globally, stablecoins are increasingly being used for supplier payouts, worker earnings, treasury operations, and eCommerce transactions.

- Challenges remain around liquidity and finding reliable on/off-ramps. The opportunity, however, is undeniable and ripe for action.

Global business is moving faster than ever, but some markets still lag behind when it comes to financial infrastructure. In many emerging markets, currency fluctuations, delayed settlements, and strict FX controls are everyday challenges to growth.

Stablecoins have emerged as a practical workaround. They give companies a way to hold and move value in dollars without depending on local banking systems. And momentum is growing: in 2024, the average global supply of stablecoins in circulation reached USD$ 208 billion.

The potential is far bigger than that. Stablecoins today account for less than 1% of all cross-border payment volumes—but they stand to face a total addressable market of approximately USD$ 16.5T. Within that opportunity, B2B payments involving emerging markets present the largest opportunity.

What are stablecoins and why do they matter?

Stablecoins are digital assets linked to stable currencies, most often USD. For businesses, stablecoins matter because they bring reliability. By combining the stability of the dollar with the efficiency of blockchain settlement, they create a foundation businesses can build on.

In practice, that means fewer surprises in cash flow, more control over liquidity, and a tool that bridges the gap where conventional banking rails might fall short.

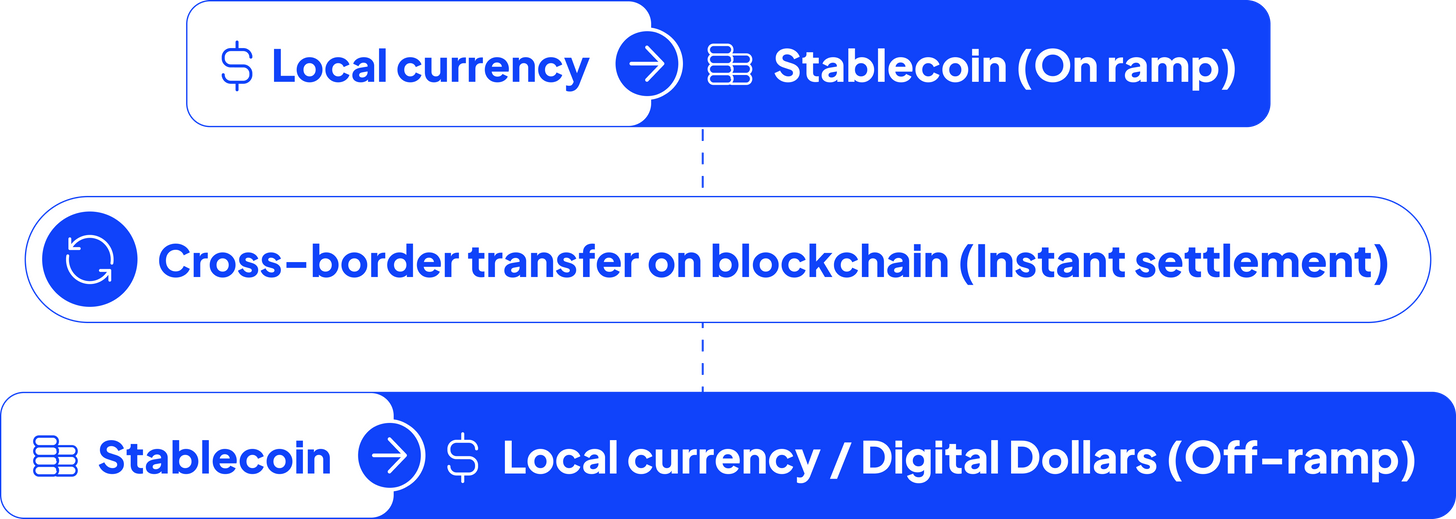

The “Stablecoin Sandwich” in cross-border flows

The mechanics of cross-border payments with stablecoins are straightforward:

- On-ramp: Local currency is exchanged for stablecoins via a regulated exchange or payment partner.

- Cross-border transfer: Stablecoins are transferred on blockchain networks, settling almost instantly.

- Off-ramp: At the destination, stablecoins can be held as digital dollars or converted into local currency for operational use.

For treasury and finance teams, this creates more flexible liquidity management. Funds can be redeployed across markets in real time, protected from local currency swings, and tracked end-to-end.

Rather than replacing fiat, stablecoins often act as a bridge layer—what some call the “Stablecoin Sandwich”: local currency converted into stablecoin, moved globally in seconds, and converted back into local currency on arrival.

Benefits for global businesses

- Faster, lower-cost cross-border payments: International transfers in emerging-market corridors often take days and involve multiple intermediaries. Stablecoins cut that to minutes, at a fraction of the cost.

- Value protection in volatile markets: In high-inflation economies, businesses can use digital dollars for invoicing and reserves, shielding capital from currency swings and supporting reinvestment.

- Access to global commerce: Stablecoins allow merchants to fund operations and settle to and from international customers without traditional USD accounts.

- More efficient payouts: Platforms serving remote teams, contractors, or gig workers can fund payouts in stablecoin while recipients continue to receive local currency.

Liquidity, infrastructure, and other challenges

- On/off-ramp liquidity: Efficient conversion between local currency and stablecoins remains essential for treasury and settlement purposes. Reliable partners and robust local liquidity are critical.

- Security and controls: Safeguarding digital assets requires technical infrastructure and rigorous internal controls supported by trusted third-party providers.

- Operational alignment: Successful adoption requires educating finance, legal, and operations teams and integrating new workflows with existing systems.

A promising step forward is the rise of global networks that link digital asset infrastructure with local payment rails and know-how. Fireblocks has built one of the largest ecosystems in the world. By joining the Fireblocks Network for Payments, dLocal is working to make stablecoin funding and settlement a practical option for businesses operating in emerging markets.

Ultimately, this kind of payment infrastructure is what makes stablecoins useful in day-to-day operations. To move from experimentation to scale, companies need reliable ways to convert between digital dollars and local currencies, which can be plugged into familiar payment methods and operate within compliant frameworks.

Rather than replacing fiat, stablecoins act as a bridge layer, moving globally in seconds

How businesses are using stablecoins

- Supplier and vendor payouts: Companies are increasingly using stablecoins to settle international invoices, reducing costs and improving efficiency in markets with limited FX availability.

- Platform and gig worker payouts: Digital platforms use stablecoins for funding and settlement, while workers and sellers continue to receive local fiat currencies.

- Treasury management: Companies in high-inflation economies use stablecoins to preserve value and move liquidity across borders more efficiently.

The road ahead

Stablecoins are gaining traction as a treasury and settlement tool for businesses operating in emerging markets. Big businesses are beginning to fold them into their payment strategies, setting the stage for wider adoption.

Challenges remain, but as the foundation strengthens, stablecoins are likely to become part of the digital business backbone—helping companies handle volatility, cut costs, and move money across borders more efficiently. Businesses that start testing now will be better prepared as digital money becomes everyday infrastructure.

Key takeaways

- Stablecoins provide faster, lower-cost cross-border funding and settlement, reducing processing times from days to minutes and lowering operational fees.

- Stablecoins help businesses hedge against volatile local currencies, supporting resilient cash management in high-inflation regions.

- By streamlining treasury flows and reducing reliance on traditional banking infrastructure, stablecoins allow businesses to expand global reach and simplify cross-border operations.

- Companies can streamline supplier, payroll, and contractor disbursements—improving cash flow and operational efficiency.

- Adoption continues to rise, supported by expanding regulatory clarity and better local liquidity; businesses that act now will gain a strategic edge.

Get in touch with our payment experts

We help global companies such as Amazon, Spotify, and Microsoft find new opportunities in high-growth markets. Let's think outside the box for tailor-made payment solutions for your business. Fill out this form, and we'll get back to you as soon as possible.

Contact us