BNPL Fuse

Why choose one BNPL, when you can Fuse them all?

The only BNPL aggregator built for emerging markets

- One API / One integration

- Eight markets

- 500M+ buyers

- Zero risk

The hidden cost of not offering BNPL

Shoppers everywhere expect flexible ways to pay. In emerging markets, limited access to credit means many can’t pay for larger buys without installments.

![Up to [REPLACE_NUM] of carts are abandoned without BNPL Up to [REPLACE_NUM] of carts are abandoned without BNPL](https://d13wxjfb6x6swr.cloudfront.net/images/the-hidden-cost-of-skipping-bnpl.png)

Up to 66% of carts are abandoned without BNPL

For merchants, building BNPL in-house is complex: credit checks, fraud risk, regulations, and fragmented providers turn a growth driver into an operational burden.

How people use BNPL

What started as a niche tool is now a mainstream way to pay. Buy Now, Pay Later helps online shoppers afford more and digital merchants sell more.

What it means at checkout

-

Shoppers choose to pay later (14 to 30 days) or split purchases into installments

-

Merchants get paid upfront — no risk, no delays

The result?

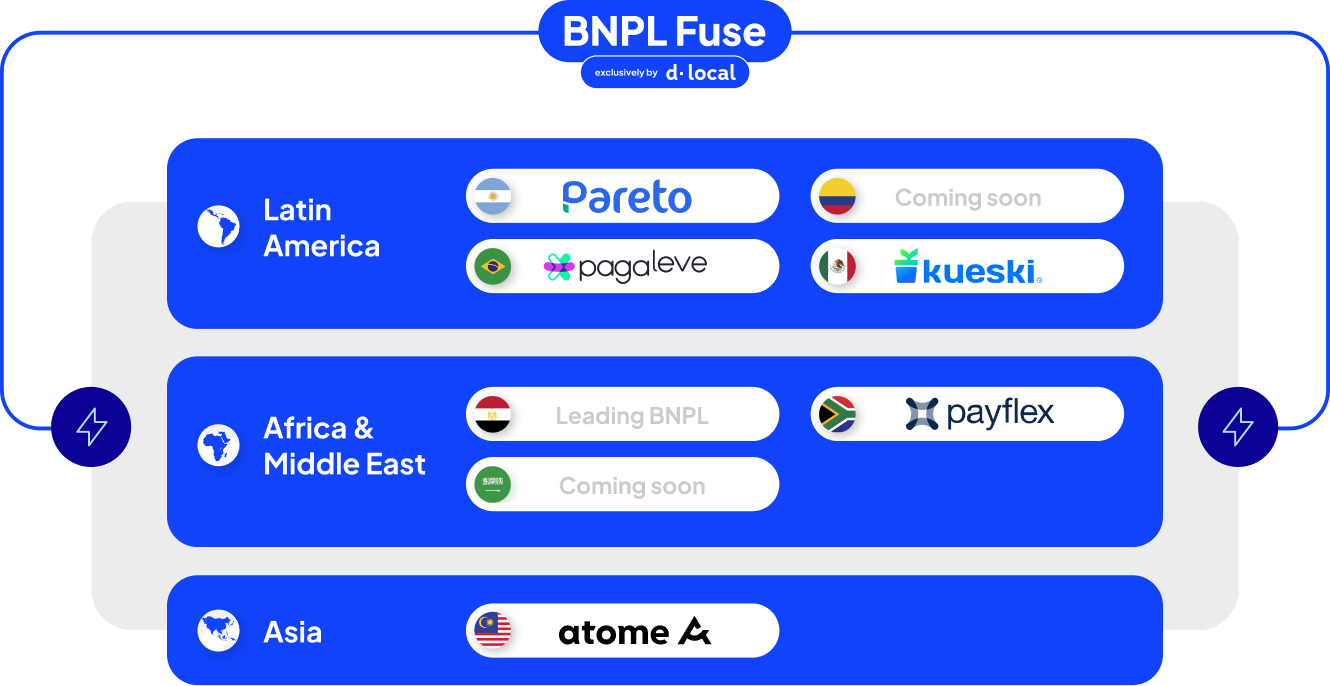

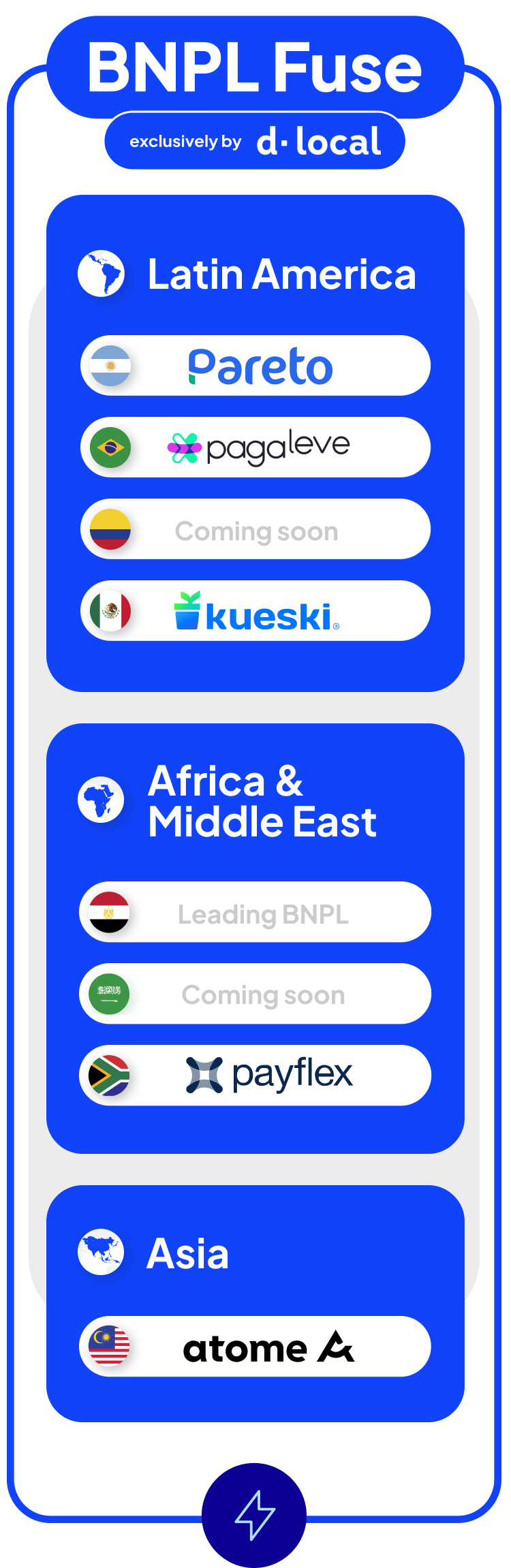

BNPL Fuse, exclusively by dLocal

The only BNPL aggregator built for emerging markets

BNPL Fuse connects the leading Buy Now, Pay Later providers across emerging markets.

With one API:

- Go live in 8 markets

- Reach 500M+ buyers

- Offer BNPL with zero credit risk

Instead of managing multiple integrations, BNPL Fuse gives you a single orchestration layer, so you can focus on growth, not complexity.

How BNPL Fuse works

Leading BNPL providers, global reach

From Africa & the Middle East to Asia and Latin America, Fuse brings together local BNPL champions in markets with young shoppers, low card penetration, and high mobile adoption, making installments thrive where credit is scarce but demand is rising.

Powered by dLocal’s experience layer

Connecting merchants and BNPL providers where growth happens next

- Higher conversions and larger order values

- Frictionless checkout with local payment methods

- White or grey-label flexibility (coming soon)

- Pre-approved credit lines and users

- One API connecting all leading BNPL providers, built for scale

From checkout to payout, the Fuse way

-

Merchants offer installments directly at checkout

-

Buyers split payments using local or alternative payment methods

-

Merchants receive full payment upfront

Creating real impact

-

Travel & Hospitality

Big trips come with big price tags. Flights, hotels, and packages feel easier to book when the cost can be spread over time. With BNPL Fuse, platforms capture more bookings.

-

Retail & Marketplaces

From fashion to electronics, shoppers are more likely to complete their purchase if they don’t have to pay all at once. BNPL Fuse helps reduce abandoned carts and increase order values.

-

Gaming

Players don’t want interruptions at checkout. Offering BNPL keeps them engaged and makes it easier to pay for subscriptions, upgrades, or in-game purchases.

-

eLearning

Education is an investment. By giving students the option to split costs, online education platforms make learning more accessible and affordable, without waiting for funds to clear.

-

Streaming & SaaS

Subscriptions stack up quickly. With BNPL, users commit with less hesitation, and platforms benefit from stronger retention and a broader audience.

Trusted by leading BNPL providers

*Availability and conditions may differ by market

Want to go deeper?

How global merchants can simplify Buy Now, Pay Later (BNPL) integrations in emerging markets

Learn how a single Buy Now, Pay Later integration helps global merchants access millions of new buyers and increase sales in emerging markets.

Webinar replay

The checkout opportunity powered by BNPL Fuse

BNPL is changing checkout expectations across emerging markets. Watch the on-demand session to hear what providers in Brazil and South Africa are seeing on the ground and how merchants can connect multiple local BNPLs through one integration.