Bre-B goes live in Colombia.

Colombia’s new government-backed real-time payment rail is set to change how money moves.

Be launch-ready from day one and stay covered as Bre-B grows.

Understanding Bre-B

Bre-B is the national real-time payment system developed by Banco de la República.

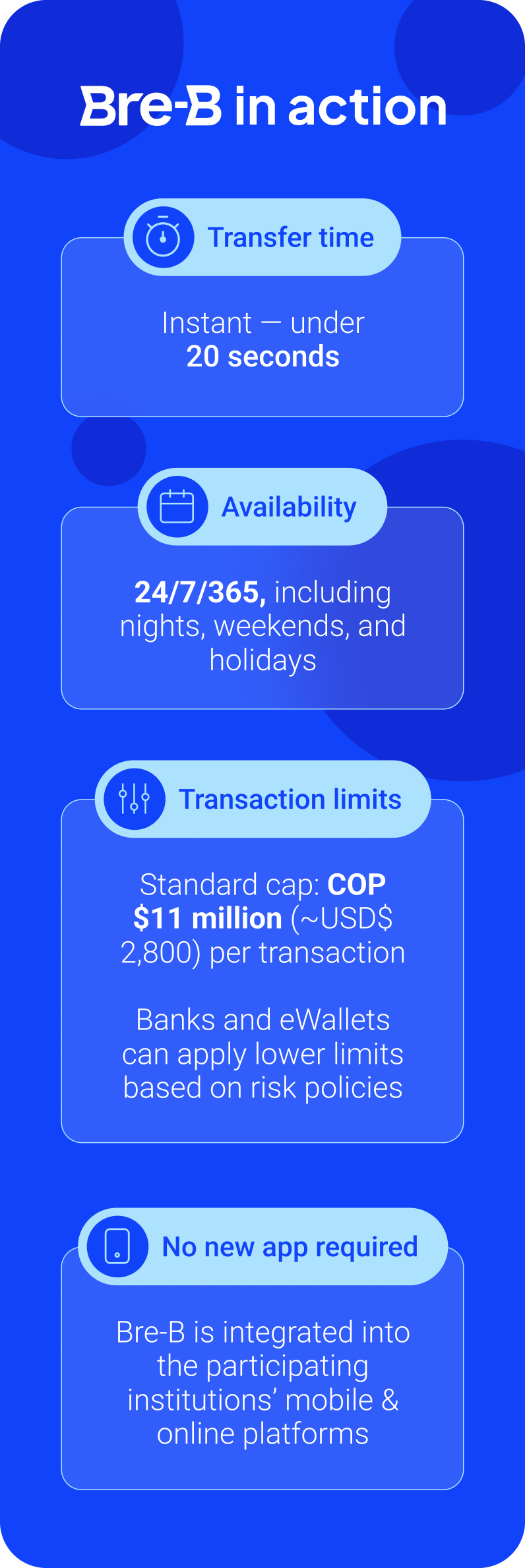

It enables 24/7 account-to-account transfers using digital keys (llaves) — phone numbers, IDs, emails, or custom aliases — instead of full bank account details.

At launch, users will be able to process:

-

P2P transfers

-

P2M payments

Bre-B is mandatory for Colombian banks and eWallets, meaning true interoperability for the first time in the country.

Bre-B changes the game for Colombia

With Bre-B, businesses in Colombia can:

-

Accept instant payments from any bank or eWallet.

-

Reduce checkout friction — no more long account numbers.

-

Operate 24/7/365, including nights, weekends, and holidays.

-

Benefit from zero-cost adoption as transactions remain free for end users until 2028.

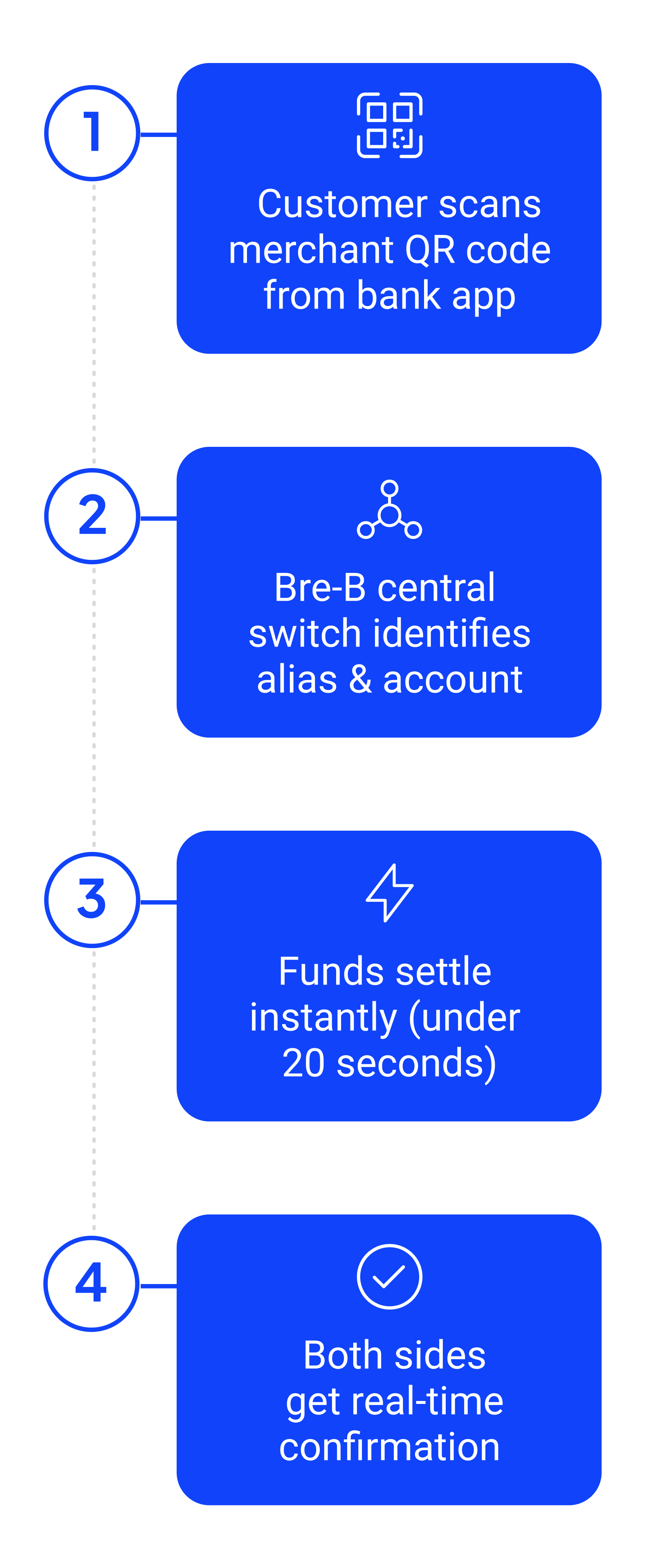

Inside Bre-B’s payment flow

No new app required — Bre-B will be integrated into existing banking and wallet platforms.

Beyond faster payments:

Bre-B’s impact

-

Drive financial inclusion

-

Reduce reliance on cash (78% of daily transactions)

-

Enable new use cases in the future, from B2B payments to government disbursements

Want to go deeper?

Getting ready for Bre-B

What you need to know about Colombia’s new RTPl: rollout, digital keys, and what it means for merchants.

Bre-B: A payment team’s guide

A deeper look at how Bre-B works in practice, what problems it solves, and the opportunities it creates for merchants and end-users.

Colombia’s payment landscape in context

Our Emerging Markets Payments Handbook 2025 unpacks Colombia’s economy, digital growth, payment preferences, regulation, and key trends, including how Bre-B fits in.

Ready for Bre-B. Ready to stay ahead.

Integrate Colombia’s new real-time payment method with dLocal. Be ready for launch, and future-ready for what comes next.

Talk to our team