Unlock the power of LATAM retail: essential consumer insights from our payments survey

The next global retail frontier is here, and it's mobile-first.

-

High-growth economies

Some LATAM countries are poised to become among the world's largest economies in coming decades, surpassing established markets.

-

Young, digital-first populations

With median ages significantly younger than developed markets (e.g., 32.5 in Colombia, 32.9 in Argentina, 32.7 in Brazil), these consumers are digital natives.

-

Hunger for global access

A vast, digitally savvy population is eager to connect with global products and services, often for the first time, or to move beyond existing financial barriers.

This report provides a first look into these crucial consumer attitudes – from payment preferences and brand perceptions to the influence of tariffs. It’s particularly timely, marking a new era of cross-border payment solutions that make entering LATAM and other emerging markets far less risky and significantly more attractive than ever before.

"In today’s rapidly expanding global economy, the true frontier for growth lies in emerging markets. Data from our latest Retail & Payments Survey confirms a fundamental truth: payments are inherently local. Over 94% of LATAM consumers prioritize accessible payment options, yet nearly 70% are unlikely to purchase from sites not supporting these local preferences. This is why payment localization isn't optional—it's a prerequisite for conversion.

It’s no longer about international credit cards; it’s about seamlessly integrating the preferred Alternative Payment Methods (APMs) – from mobile money to real-time systems like Pix – which have become the primary way to pay and are set to surpass cards in key LATAM markets by 2026.

Our deepest commitment is to simplify this complexity for global companies. Through a single integration to over 900 local payment methods across more than 40 geographies, and built on operational excellence and deep regulatory compliance, dLocal provides the solution. Backed by over 30 licenses worldwide, including our recent FCA license in the U.K., our strength lies in partnering with local banks, payment service providers, governments, and regulators to make universal access to the global digital economy a reality across Africa , Asia, and Latin America. This is how we foster trust, enable true scale, and deliver real financial inclusion."

Carlos Menendez Chief Operating OfficerCarlos Menendez is a seasoned general manager with extensive global experience in creating and scaling businesses, known for his ability to construct successful business models with operational rigor.

He served as the President of the Global Commercialization Office at Mastercard, where he led the scaling and management of new global P&Ls, key initiatives, and drove growth across existing and emerging segments. During his 14 years at Mastercard, Carlos held various leadership roles, including Group Executive for Global Credit, Debit & Network Products, where he was responsible for building the company’s consumer products globally and deploying solutions at the local market level for billions of cardholders.

Before joining Mastercard, Carlos spent 14 years at Citi, where he held several senior roles, including COO of Western Europe Retail Banking, EMEA Bankcards Regional Director and CFO of Citibank USA. Carlos holds a BA in Economics from Harvard University, an MBA in Finance from The Wharton School, and an MA in International Studies from the Lauder Institute at the University of Pennsylvania.

Carlos Menendez, COO

Understanding the LATAM Shopper: quality & local payments rule

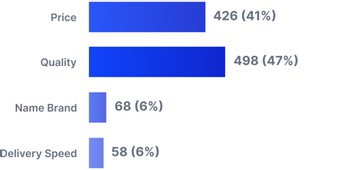

When shopping online, quality is paramount for nearly half (47%) of LATAM consumers, with price a close second at 41%. This signals a massive opportunity for high-quality global brands, as cross-border payment technology is now breaking down what were once prohibitive barriers like lack of local currency options or Alternative Payment Methods (APMs).

What's most important to you when comparing products while shopping online?

Source: dLocal Retail Survey LATAM 2025 Countries: Argentina, Mexico, Brazil, Chile, and Colombia

However, our research reveals a critical challenge: payment friction. Despite surging demand for online shopping, consumers are frequently stopped short. According to our survey:

- 45% of respondents indicated the lack of Alternative Payment Methods (like eWallets, bank transfers, mobile payments, or prepaid cards) is a major barrier to completing purchases.

- 21% cited not being able to pay in their local currency.

- 33% noted the unavailability of "Buy Now, Pay Later" (BNPL) options.

This is a clear warning for online retailers: The market is far less saturated than many believe, and offerings often considered standard by businesses are surprisingly absent for consumers.

What barriers do you face when paying for products online? [select all that apply]

![What barriers do you face when paying for products online? [select all that apply] What barriers do you face when paying for products online? [select all that apply]](https://d13wxjfb6x6swr.cloudfront.net/images/3187/205/133_what-barriers-do-you-face_q90.jpg)

Source: dLocal Retail Survey LATAM 2025 Countries: Argentina, Mexico, Brazil, Chile, and Colombia

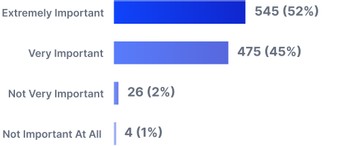

Payment options aren't just important, they're a prerequisite for conversion.

The data is unequivocal: over 94% of LATAM consumers consider accessible payment options "important" or "extremely important" for any eCommerce experience, with over half calling it "extremely important."

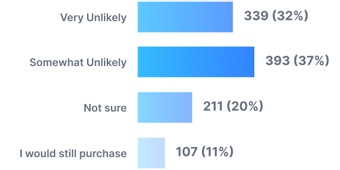

And the consequences of not meeting this expectation are stark. Our poll results reveal a strong dependency on localized and alternative payment methods: nearly 70% of consumers (32% "very unlikely" and 37% "somewhat unlikely") say they would be unlikely to purchase from a website that doesn't support these options. Only a mere 10% would proceed without them.

LATAM eCommerce market is growing at roughly 9.5% per year with a market penetration rate jumping nearly 10% to 66% during the same time period. Providing accessible payments, therefore, is the key to a robust, nearly multi-trillion-dollar eCommerce market.

When purchasing products online, how important are accessible payment options for you?

Source: dLocal Retail Survey LATAM 2025 Countries: Argentina, Mexico, Brazil, Chile, and Colombia

What benefits do you anticipate if Latin America's importance grows for global retailers? [select all that apply]

![What benefits do you anticipate if Latin America's importance grows for global retailers? [select all that apply] What benefits do you anticipate if Latin America's importance grows for global retailers? [select all that apply]](https://d13wxjfb6x6swr.cloudfront.net/images/3189/212/what-benefits-do-you-anticipate_q90.jpg)

Source: dLocal Retail Survey LATAM 2025 Countries: Argentina, Mexico, Brazil, Chile, and Colombia

The dominance of local payments in LATAM eCommerce

Our latest poll confirms a key trend in Latin American eCommerce: a strong reliance on local and alternative payment methods. Nearly 70% of consumers say they would be unlikely to buy from a site that doesn’t support them, while only 10% would proceed without these options.

This isn’t just a preference—it’s a regional shift. Local methods now power about half of all digital transactions in LATAM and are expected to overtake cards in key markets by 2026.

Take Pix in Brazil: this instant payment method is set to surpass credit cards in eCommerce by 2025. eWallets are also surging across markets like Mexico and Argentina, becoming part of everyday life.

The message is clear: payment localization isn’t optional—it’s essential for conversion.

How likely would you be to buy from an e-commerce website if it did not accept payments in your local currency or an alternative payment method?

Source: dLocal Retail Survey LATAM 2025 Countries: Argentina, Mexico, Brazil, Chile, and Colombia

Source: dLocal Retail Survey LATAM 2025 Countries: Argentina, Mexico, Brazil, Chile, and Colombia

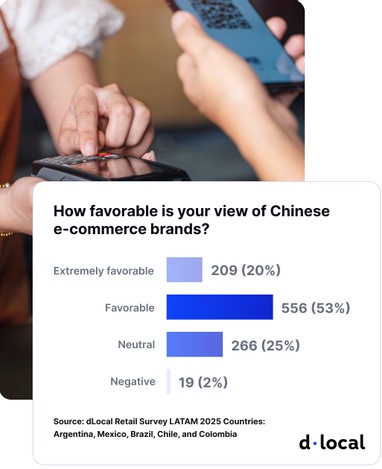

Chinese brands are widely respected, but LATAM consumers are still open to newcomers

Latin American consumers hold a highly favorable view of Chinese eCommerce brands—73% express positive or extremely positive opinions, and fewer than 2% report negative sentiment. Young adults (18–24) are the most enthusiastic, with 22% viewing these brands extremely favorably.

This reflects the strong presence of platforms like AliExpress, Shein, and Temu, which have gained traction through low prices, broad product ranges, and localized logistics. A 2023 Statista study found Shein to be one of the most downloaded shopping apps in Latin America, highlighting not just awareness but active engagement.

Despite the positive sentiment, buying frequency remains moderate: only 7% shop “all the time,” while 52% do so “sometimes.” This suggests admiration for these platforms is tempered by factors like income, spending habits, or import limits such as the de minimis threshold. Still, with low dissatisfaction and shifting U.S. trade policies, growth prospects remain strong.

Your partner for growth: our "One dLocal" Model

Connecting Global Ambition with Local Reality.

At dLocal, we simplify the complexity of payments for global businesses. We are the leading payment experts in emerging markets, dedicated to unlocking the power of LATAM retail by connecting global companies with consumers in high-growth regions. Our unique "One dLocal" model provides the local infrastructure and guide rails required to securely enable your geographic expansion.

Here's how we ensure you meet the LATAM consumer where they are, driving trusted expansion and optimizing direct integrations:

-

Deep local payment coverage:

We offer over 900 local payment methods across more than 40 geographies in Africa, Asia, the Middle East, and Latin America, simplifying complexity with a single integration, contract, and support point.

- This includes the rapid dominance of Pix in Brazil, expected to surpass credit cards in eCommerce use by 2025.

- It covers the surge of eWallets, now used by roughly 60% of LATAM's population and accounting for nearly half of all eCommerce payments in key markets like Argentina.

- Even cash-to-digital methods like OXXO in Mexico or PagoEfectivo in Peru are covered, transforming traditional habits into digital access.

-

Strategic Compliance & Trust

Our over 30 licenses and registrations worldwide, including the Financial Conduct Authority (FCA) license obtained earlier this year in the U.K., demonstrate our deep commitment to regulatory compliance. We are a publicly listed company on Nasdaq since 2021, operating with the strictest regulatory requirements.

-

Proven Scalability

Our single API allows customers to seamlessly add geographies to their offerings, enabling rapid scaling, unlocking revenue opportunities, and realizing potential savings based on volume. This means a unified dashboard that simplifies management compared to juggling numerous solutions.

-

Lessons from Global Leaders

Just like successful Chinese retailers who embraced a localized payment approach through the dLocal platform to offer affordable, seamless payments, we empower brands to connect with consumers on their terms.

-

Future-Proofing your business

LATAM is set to account for 65% of global economic growth by 2035, driven by a young, mobile-first population, with nearly 90% of consumers under 20 residing in emerging markets by 2050. This is a long-term opportunity that demands deep localization.

The shift is already happening, and businesses that understand the local dynamics have a clear opportunity to lead.

Ready to Capture LATAM's Potential?

Partner with dLocal – The Local Experts, Globally Trusted.

Success in Latin America isn't about exporting old playbooks. It's about adapting to the region's unique dynamics, user behaviors, and regulatory tempo. dLocal provides the technology and local expertise to turn ambition into impactful growth.

Don't miss the ride – connect with us today to understand how dLocal can transform your retail strategy in LATAM.