How global merchants can simplify Buy Now, Pay Later (BNPL) integrations in emerging markets

Learn how a single Buy Now, Pay Later integration helps global merchants access millions of new buyers and increase sales in emerging markets.

Offering Buy Now, Pay Later (BNPL) services is now a must for global merchants. It’s how many prefer to pay in emerging markets. Yet bringing local BNPL options to your checkout isn’t always simple.

Every market plays by its own rules: different providers, regulations, and buyer behavior. What should be a straightforward way to grow often turns into a lengthy integration process and a fragmented experience for both merchants and their customers. And the integration itself is only the starting point, staying aligned with partners, optimizing performance, and keeping up with regulatory updates requires ongoing work that most teams don’t have the bandwidth for.

BNPL Fuse allows global businesses to offer flexible payment installments to consumers across emerging markets with just one integration. By aggregating multiple local BNPL providers under a single API and contract, BNPL Fuse simplifies compliance, reduces operational complexity, and gives merchants instant access to hundreds of millions of underbanked buyers. The result is higher conversion, larger baskets and easier local adoption.

What is Buy Now, Pay Later (BNPL)?

Buy Now, Pay Later (BNPL) is a payment solution that allows people to purchase goods and services instantly and spread the payments over smaller, manageable installments. This is especially helpful in places where credit cards aren’t common or where buyers' credit limits are low, giving shoppers a practical way to buy what they need while keeping their budgets on track.

Why BNPL is critical for growth in emerging markets

Interest in BNPL keeps growing across regions like Africa, the Middle East, Asia or Latin America, and there are some clear reasons behind this trend.

For global merchants, understanding these factors opens doors to new customers and increased sales, something we explored in depth in our Emerging Markets Payments Handbook 2025.

Examples of BNPL growth: In Malaysia, BNPL holds around 8% of the payment mix. In Saudi Arabia, the same payment method accounts for nearly 1 in 10 online transactions, particularly for electronics and high-ticket goods.

Key factors

- Low credit card penetration: Owning a credit card isn’t widespread in emerging markets, with penetration below 40%. This leaves millions without access to formal credit. BNPL bridges this gap, offering an accessible form of credit.

- Growing eCommerce adoption: As more consumers shop online, they seek payment methods that are flexible, secure, and aligned with their budgets.

- Trust in local providers: Consumers often show a strong preference for local BNPL brands that understand regional payment habits and offer familiar repayment methods

- Desire for high-ticket items: BNPL makes it possible for more people to purchase expensive items like electronics, travel packages, and educational courses by spreading the cost over time. Gen Z and younger shoppers often save less upfront, yet still aspire to the same products as older generations.

The challenge: Cross-border BNPL isn’t straightforward for merchants

Even though many shoppers want Buy Now, Pay Later, setting it up across borders can be challenging for merchants.

- Multiple providers, multiple builds: Every BNPL provider has its own API, data requirements, and approval processes. A global business expanding into just five markets could face five separate, resource-intensive engineering projects, significantly delaying time-to-market.

- Ongoing performance & compliance upkeep: The work doesn’t stop once the integration is live, each provider also requires ongoing coordination to keep performance strong and maintain compliance as regulations change.

- Regulatory inconsistency across markets: BNPL regulations are not standardized globally. Managing different disclosure rules, data handling policies, and settlement requirements creates significant operational drag.

- Poor user experience: Many BNPL solutions redirect customers to an external site to complete an application. This added friction creates distrust and is a direct cause of cart abandonment.

The Solution: How BNPL Fuse simplifies global expansion

When we talk about BNPL Fuse, what really matters isn’t just the single integration, it’s everything that comes with it. Since we work directly with BNPL providers in each market, we get a front-row view of how people shop, what information improves approval rates, and how shoppers prefer to repay installments. Those learnings don’t sit in a report somewhere, we fold them straight into the product. Every integration makes BNPL Fuse smarter, and every merchant benefits from what we've already learned in the field.

With one unified API, merchants connect to multiple BNPL providers without handling separate contracts, approval logic, or compliance details. We manage those differences behind the scenes, so BNPL doesn’t become five different engineering projects for five different countries.

But Fuse is more than an aggregator. We built an experience layer because just connecting isn’t enough if the shopper drops out mid-flow. BNPL Fuse adapts to local repayment behavior, and presents installment choices in a way that feels more familiar to the buyer.

Today, we’re live with partners like Kueski in Mexico, Pagaleve in Brazil, Atome in Malaysia, Pareto in Argentina and Payflex in South Africa, among others, with more coming as we expand the network.

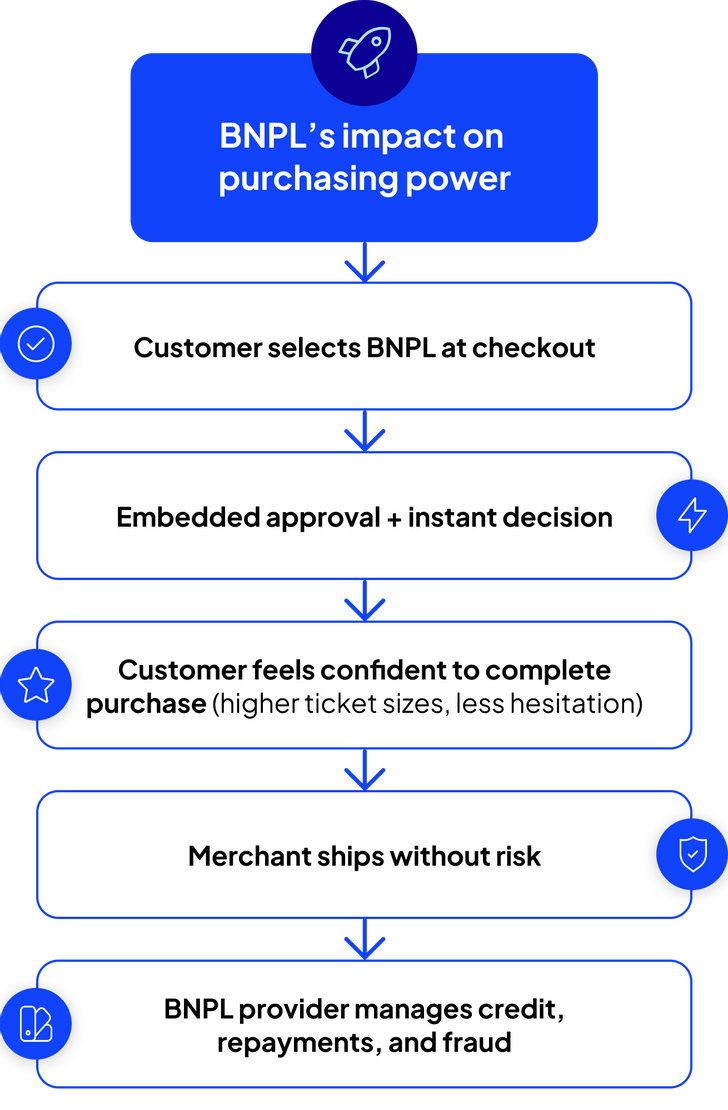

How BNPL Fuse works. A step-by-step view.

When a merchant connects to Fuse, they’re not just adding another payment option, they’re tapping into a setup that was built to make BNPL work at scale across markets with different rules, data needs, and repayment methods. Our role is to handle the complexity so the experience feels simple and predictable from checkout to settlement.

Here’s how it plays out:

- Installments shown during checkout: BNPL options appear at the merchant’s checkout.

- The shopper selects their local BNPL provider & plan: They pick the installment option they trust. Local brands drive higher confidence and higher completion rates.

- Instant approval decisions: The provider runs their checks in real time. Once approved, the merchant receives confirmation immediately and can fulfil the order.

- The merchant gets paid upfront, always: Settlement to the merchant is immediate. The BNPL provider handles the installments, credit risk, fraud, and buyer relationship behind the scenes.

And because we’re live in multiple markets, we see real insight patterns that get fed back into the product. We take those findings and bake them into Fuse, so the next merchant entering that market benefits automatically, without reinventing the flow or running tests themselves.

Which industries benefit most from a unified BNPL layer?

A single BNPL integration opens access to customers who prefer to split payments, especially when the purchase value is high or credit cards aren’t available. We see strong adoption across several sectors:

Travel & Hospitality:

Installments help customers commit to larger bookings like flights and accommodation, improving completion rates for long-haul and higher-value trips.Retail & Marketplaces:

Shoppers tend to add more when they can spread payments. Marketplaces also avoid the overhead of integrating several BNPL providers separately.Gaming:

Mobile-first users often rely on APMs rather than cards. Installments make higher-value bundles, gear, and upgrades more achievable.eLearning:

Students and professionals can enroll more confidently when they can pay over time, especially with BNPL providers they already know.Subscriptions:

Short-term installment plans help users start or renew services in markets with low card penetration, giving recurring products a more accessible entry point.

A unified BNPL layer matters most where customers value flexible payment options for higher-ticket purchases.

Conclusion: A smarter way to bring BNPL to new markets

BNPL is important for growth in emerging markets, but managing separate providers makes it harder than it needs to be. BNPL Fuse removes that overhead. One integration connects you to local BNPL partners and hands credit risk to the provider. It’s a practical way to offer installments in new regions without rebuilding your payment stack country by country.

BNPL Fuse will continue growing with new local providers and added configuration options, including white-label and grey-label flows for merchants who want tighter control over UI and brand. Our focus stays where it matters: reliability, simple checkout flows, and payment options people actually use.

Ready to reach hundreds of millions of new buyers? Contact our team today and discover how BNPL Fuse can simplify your payment stack.

*Disclaimer: BNPL providers, terms, and eligibility vary by market. BNPL Fuse adapts to local conditions rather than enforcing a global template

Frequently Asked Questions

What is Buy Now, Pay Later (BNPL)?

Buy Now, Pay Later (BNPL) is a payment option that allows customers to buy goods or services immediately and repay the amount in smaller installments over a set period. It reduces the need for credit cards and lowers upfront cost barriers, making purchases more manageable. In emerging markets, BNPL is often the preferred alternative for shoppers without access to formal credit.

Which products or price ranges work best with Buy Now, Pay Later?

BNPL is most effective for mid to high-value purchases where upfront payment creates friction. Electronics, travel bookings, eLearning programs, retail carts, and gaming bundles typically see strong adoption. BNPL also improves impulse conversion for smaller goods, especially in mobile-first emerging markets.

How does Buy Now, Pay Later work for merchants?

BNPL appears at checkout as a flexible payment option, letting shoppers split the purchase while merchants get paid upfront. It allows merchants to offer installment payments at checkout while still receiving the full transaction amount upfront. Instead of managing credit risk themselves, merchants integrate with a BNPL provider that evaluates the shopper, approves the installment plan, and collects repayments over time

Does Buy Now, Pay Later increase conversion and order value for merchants?

Yes. Offering BNPL at checkout often leads to higher conversion rates and bigger basket sizes, because buyers can split payments instead of paying in full. For global brands entering emerging markets, this payment flexibility is a key growth lever.

Do shoppers need a credit card to use BNPL?

Many BNPL providers in emerging markets support repayment via debit cards, bank transfers, eWallets, or cash-based rails. This makes Buy Now, Pay Later accessible to underbanked consumers without formal credit.

Can BNPL be offered alongside cards, wallets, and other APMs?

Yes. BNPL works best when presented as part of a localized payment mix, especially where alternative payment methods dominate over cards. Choice drives completion and trust.

How to choose a Buy Now, Pay Later provider?

For global merchants, the best fit is usually the provider that expands reach without slowing down engineering or adding friction to checkout.

Merchants often end up integrating multiple providers to cover regions, regulations, and user behaviors. That model works, but it’s slow, costly, and difficult to maintain. A unified BNPL layer like Fuse removes that overhead by connecting you to multiple local providers through one API, one contract, and one experience.

What is BNPL Fuse?

BNPL Fuse is a Buy Now, Pay Later aggregator built for global companies expanding into emerging markets — a buy now pay later for business solution designed for scale.

Which emerging markets does BNPL Fuse support?

BNPL Fuse connects merchants to leading providers across 8+ emerging markets, including Mexico, Brazil, Argentina, Malaysia, and South Africa, with our network of partners continuously expanding.

Do merchants have to manage credit and fraud risk with BNPL Fuse?

With BNPL Fuse, credit and fraud risk is managed by the local BNPL providers. Merchants receive their payment upfront, ensuring predictable cash flow.

How do I get started with BNPL Fuse?

Integrating BNPL Fuse is straightforward. Contact our team to discuss how to add our unified API to your checkout and begin offering flexible payment options to customers worldwide.

Can merchants customize the BNPL checkout experience with BNPL Fuse?

Our BNPL Fuse roadmap includes white-label and grey-label options for merchants who want more brand control. Contact our team to discuss more.

Get in touch with our payment experts

We help global companies such as Amazon, Spotify, and Microsoft find new opportunities in high-growth markets. Let's think outside the box for tailor-made payment solutions for your business. Fill out this form, and we'll get back to you as soon as possible.

Contact us